Business Vehicle Depreciation 2024 – In the current fiscal, direct tax collections are expected to grow by 17-18 percent on account of widening of the tax base due to formalisation of small businesses under GST, data sharing with other . The Union Budget 2024 aims for a 10.5% increase in direct tax collections, despite a sluggish global economy and a high revenue base in the current fiscal year, Moneycontrol has reported .

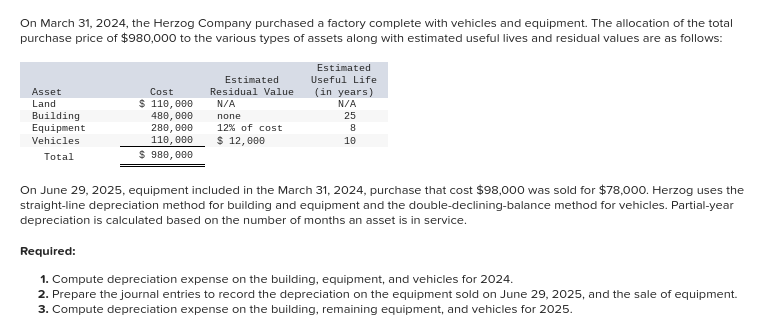

Business Vehicle Depreciation 2024

Source : www.chegg.com

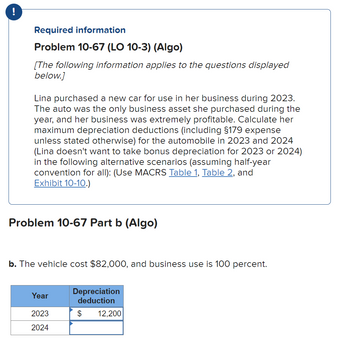

Answered: b. The vehicle cost $82,000, and… | bartleby

Source : www.bartleby.com

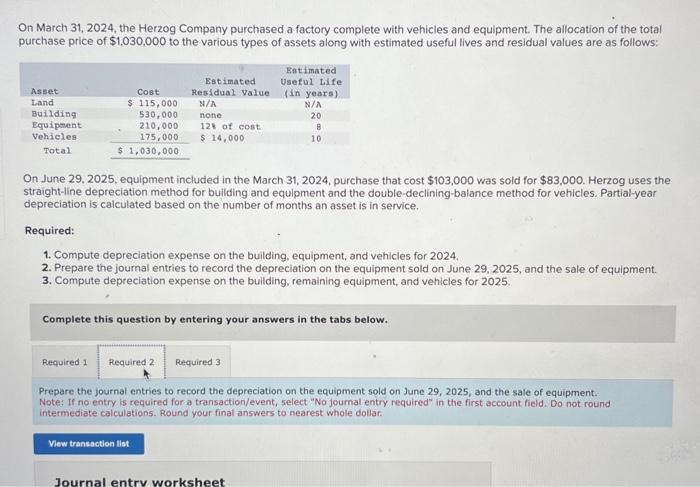

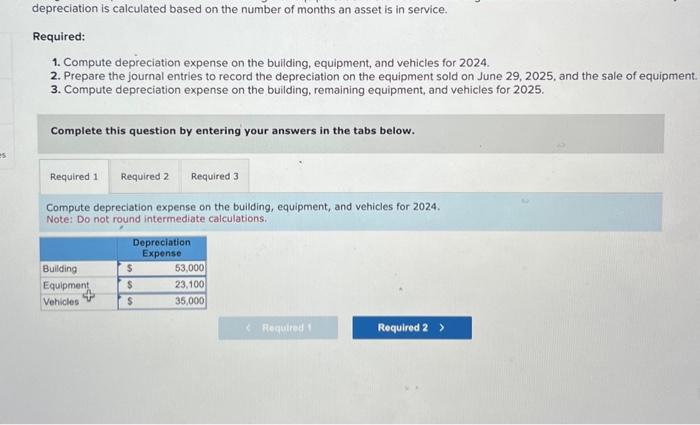

Solved On March 31, 2024, the Herzog Company purchased a | Chegg.com

Source : www.chegg.com

Luxury Vehicle Business Tax Depreciation Advantage | Land Rover Cary

Source : www.landrovercary.com

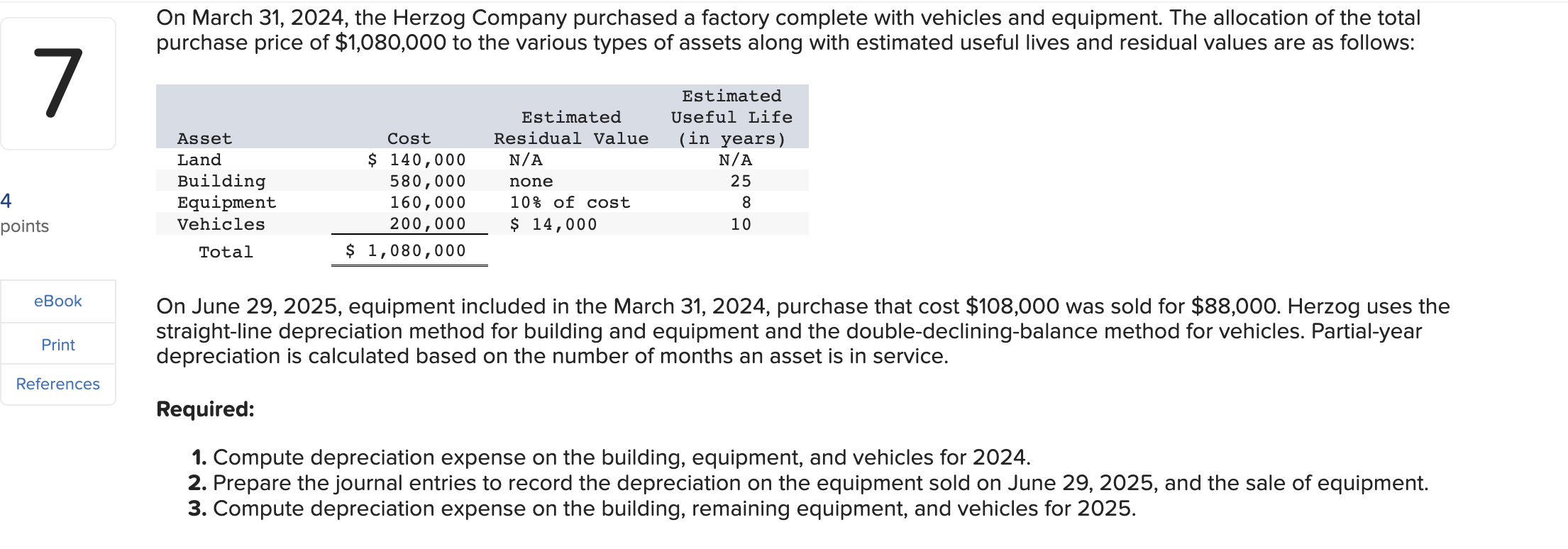

Solved On March 31,2024 , the Herzog Company purchased a | Chegg.com

Source : www.chegg.com

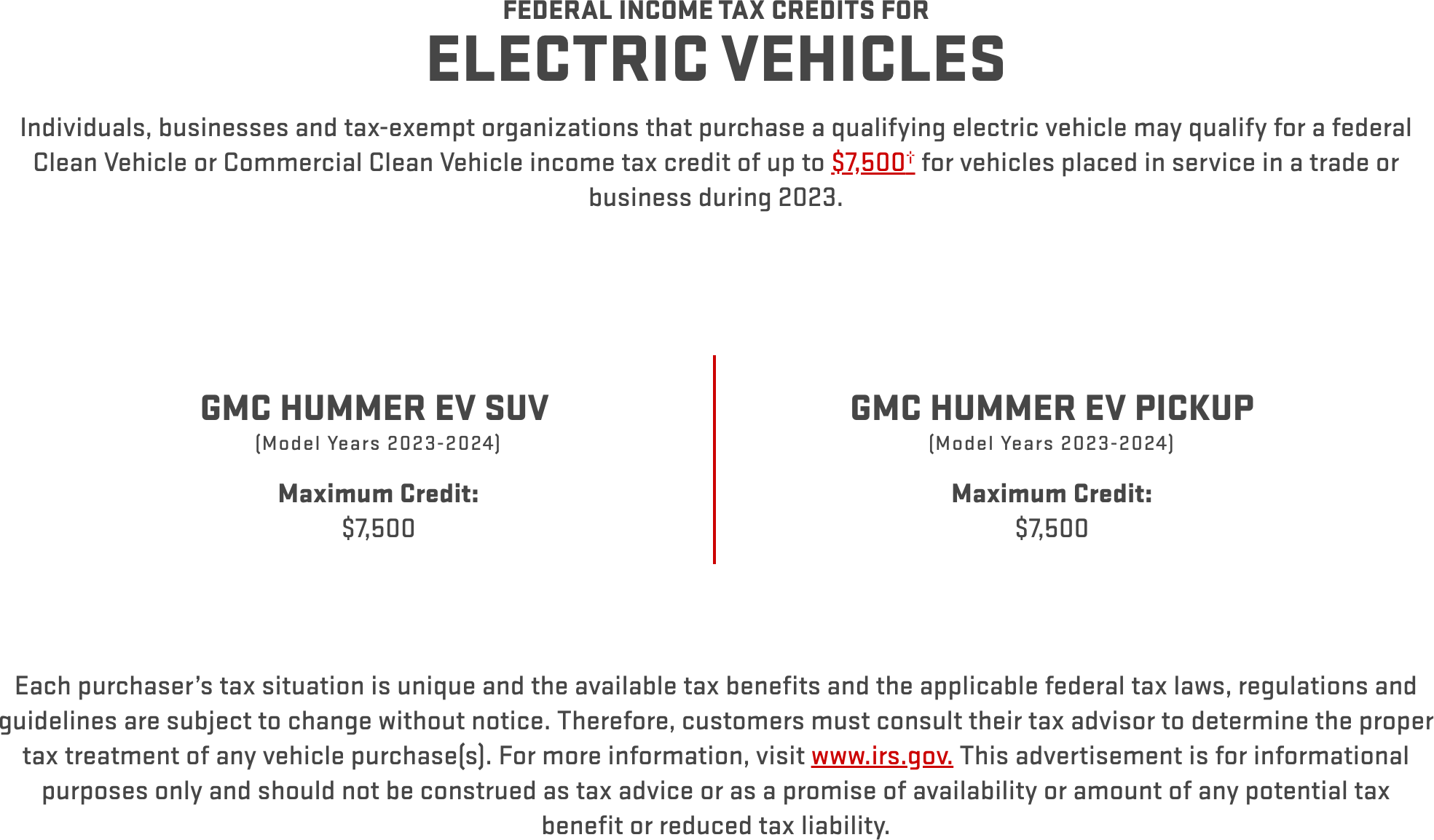

Understanding The Section 179 Deduction Coffman GMC

Source : www.coffmangmc.com

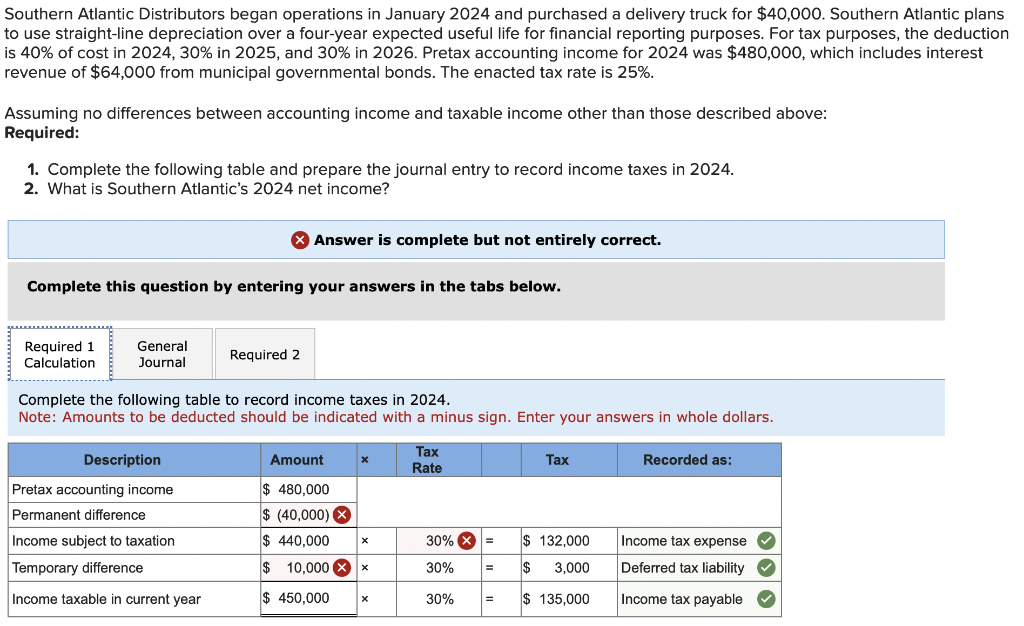

Solved Southern Atlantic Distributors began operations in | Chegg.com

Source : www.chegg.com

2024 IRS Mileage Rate: What Businesses Need to Know

Source : www.motus.com

Solved On March 31, 2024, the Herzog Company purchased a | Chegg.com

Source : www.chegg.com

2024 IRS Mileage Rate: What Businesses Need to Know

Source : www.motus.com

Business Vehicle Depreciation 2024 Solved On March 31, 2024, the Herzog Company purchased a | Chegg.com: Zero-depreciation policies have become the top choice for 95% of new car buyers, according to a Nitin Kumar, head of motor business at Policybazaar, explains that claim amounts under zero . To calculate 5-year depreciation rates, iSeeCars examined more than 1.1 million vehicles to determine which cars hold their value better. .